“Using ISSG Defined Data has enhanced my ability to make informed, responsible investment choices by focusing on governance and diversity metrics. It’s been a game-changer for aligning my portfolio with sustainable practices.”

ISSG Defined Data offers comprehensive insights into governance, diversity, and sustainability, helping investors make responsible, data-driven decisions. It empowers better investment choices by evaluating companies’ ethical practices and performance.

Stay tuned with us as we dive deeper into the world of ISSG Defined Data! We’ll explore how this powerful tool can transform your investment strategy and provide valuable insights for responsible decision-making.

What is ISS ESG Defined Data?

ISSG ESG Defined Data is a comprehensive set of information provided by ISS ESG, focusing on key factors like governance, diversity, and sustainability metrics of companies.

It helps investors evaluate businesses based on their ethical practices, risk management, and alignment with global sustainability standards. This data is used to make informed, responsible investment decisions, fostering more sustainable and effective portfolios.

How ISS ESG Defined Data Transforms Investment Decisions?

- Enhances Informed Decision-Making: Provides detailed data on governance, diversity, and sustainability, helping investors assess companies’ ethical practices.

- Identifies Responsible Investment Opportunities: Highlights companies with strong governance and diversity, aligning with socially responsible investment goals.

- Improves Risk Management: Offers insights into potential risks related to governance issues and sustainability factors, helping to mitigate investment risk.

- Supports Long-Term Growth: Helps investors build portfolios focused on companies with robust ethical and sustainable practices, promoting long-term returns.

- Aligns with Global Standards: Incorporates global sustainability frameworks like the UN Global Compact, guiding investments that adhere to international responsible investment criteria.

Read also: After Metariley Bloomberglaw – Strategic Insights For Smarter Investing!

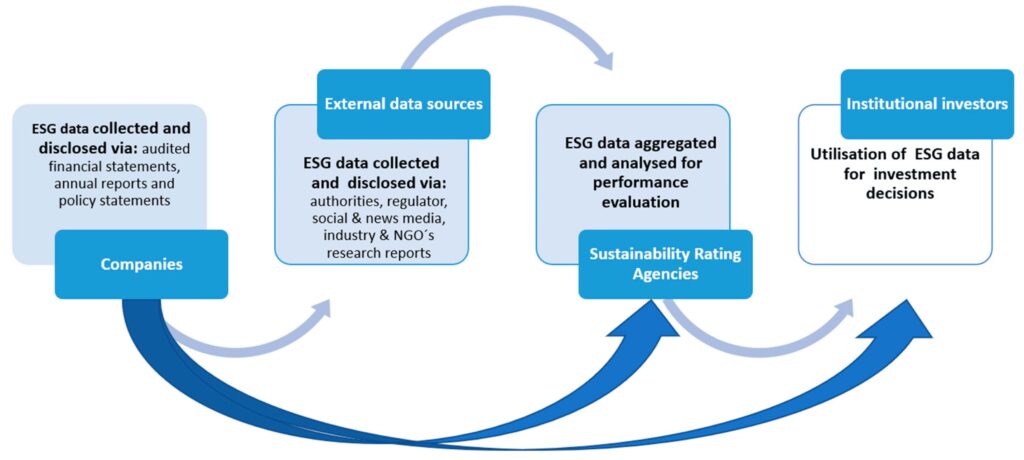

The Methodology Behind ISS ESG Defined Data – Comprehensive Data Sources!

Comprehensive Data Collection:

ISS ESG Defined Data gathers information from various sources, including company reports, regulatory filings, and third-party datasets, ensuring a thorough evaluation of governance, diversity, and sustainability factors.

Quantitative and Qualitative Analysis:

The methodology combines numerical data with qualitative assessments to provide a well-rounded view of a company’s ESG performance, considering both measurable outcomes and subjective factors.

Global Standards Integration:

It incorporates internationally recognized sustainability frameworks, such as the UN Global Compact, to ensure alignment with global best practices and to assess a company’s commitment to ethical and responsible business practices.

How to Use ISS ESG Defined Data for Better Investment Decisions?

Evaluate Governance and Diversity:

Use ISS ESG Defined Data to assess a company’s governance structure and diversity practices, ensuring that investments align with ethical standards and reduce risks related to leadership and corporate culture.

Identify Sustainable Companies:

Leverage the data to identify companies with strong sustainability practices, helping you invest in businesses committed to environmental and social responsibility.

Mitigate Investment Risks:

Analyze ESG risk factors, such as poor governance or controversial business practices, to avoid investments in companies that may face regulatory or reputational challenges.

Benchmark Against ESG Standards:

Utilize ISS ESG Defined Data’s customizable indices to benchmark investments against global sustainability frameworks, ensuring alignment with long-term ESG goals.

Monitor Ongoing Performance:

Regularly update your investment portfolio by tracking the evolving ESG scores and risk assessments of companies, adjusting your strategy as new data becomes available

Read also: Neon:Uiqmm8ciuj4= Lamborghini – Step Into Innovation!

Comparing ISS ESG Defined Data with Other ESG Data Providers – Deep Data Validation!

| Feature | ISS ESG Defined Data | MSCI ESG Ratings | Sustainalytics | Refinitiv ESG Data |

| Focus | Governance, diversity, sustainability | Broad ESG factors | ESG risk ratings | Environmental, social, and governance |

| Data Collection | Quantitative & qualitative analysis | Public disclosures & third-party research | Public filings & company data | Annual reports, regulatory filings |

| Global Standards | Integrates UN Global Compact | Aligns with global frameworks | Incorporates UNGC & SDGs | Aligns with GRI, SASB, UN Global Compact |

| Customization | Customizable indices | Limited customization | Customizable sector-specific ratings | Customizable ESG metrics |

How ISS ESG Defined Data Helps Mitigate Investment Risks?

ISS ESG Defined Data helps mitigate investment risks by providing in-depth insights into a company’s governance, diversity, and sustainability practices.

By assessing companies based on these factors, investors can identify potential risks related to ethical issues, regulatory non-compliance, or poor governance.

This data allows for more informed decisions, ensuring investments align with long-term sustainability goals and reducing exposure to companies that might face reputational, financial, or regulatory challenges.

Read also: Stylish:Cjjsglool3u= Mehandi Designs – Tradition Meets Modern Style!

The Future of ISS ESG Defined Data and Sustainable Finance – Increased Data Integration

The future of ISS ESG Defined Data and sustainable finance looks promising as demand for responsible investment grows.

With increasing emphasis on environmental, social, and governance (ESG) factors, ISS ESG Defined Data will continue to play a critical role in guiding investors towards more sustainable, ethical, and risk-conscious decisions.

As global regulations tighten and investors seek greater transparency, this data will become even more essential in shaping financial markets, promoting long-term value creation, and fostering sustainable business practices worldwide.

Conclusion:

ISS ESG Defined Data is a powerful tool that empowers investors to make informed, responsible decisions by providing comprehensive insights into governance, diversity, and sustainability practices. By leveraging this data, investors can mitigate risks, align with global sustainability goals, and drive long-term value in their portfolios.

As sustainable finance continues to gain momentum, ISS ESG Defined Data will remain a crucial resource in navigating the evolving landscape of responsible investment, ensuring a more ethical and sustainable future for both businesses and investors.

FAQS:

1. What Makes ISS ESG Different from Other ESG Data Providers?

ISS ESG stands out by offering a unique focus on governance, diversity, and sustainability with deep, qualitative insights, compared to other providers who primarily focus on broader ESG factors.

2. How Reliable is ISS ESG Defined Data?

ISS ESG Defined Data is highly reliable, sourced from rigorous data collection methods including public filings, company reports, and third-party sources. The data undergoes a comprehensive validation process, ensuring accuracy and consistency for investment decision-making.

3. Can ISS ESG Data Be Used for Global Investment Strategies?

Yes, ISS ESG Defined Data is globally applicable, integrating international standards such as the UN Global Compact. It provides insights that help investors assess companies worldwide, making it an ideal resource for global investment strategies focused on responsible and sustainable practices.

4. What Are the Key Indicators in ISS ESG Defined Data?

Key indicators in ISS ESG Defined Data include governance quality scores, diversity metrics (gender and ethnic), sustainability practices, risk management, and alignment with global ESG standards, offering a detailed picture of a company’s ethical performance and potential investment risks.

5. How Will ISS ESG Data Evolve in the Future?

As sustainable finance continues to grow, ISS ESG Data will evolve by integrating more real-time data, expanding coverage across emerging markets, and refining its methodologies to address new global regulations and investor demands for more granular ESG insights.

Read more: