Getting a mortgage felt like a big decision, and at first, I was a bit nervous. Once I understood how it worked and what it meant for my money, I felt much better. Now, I’m more comfortable making payments and planning ahead.

https://fotise.com/que-es-una-hipoteca explains that a mortgage is a loan to help you buy a home, where the house is used as security. You make monthly payments for 15-30 years, covering both the loan and interest.

Lets talk abot the further detail about thishttps://fotise.com/que-es-una-hipoteca So, Stay connected with us.

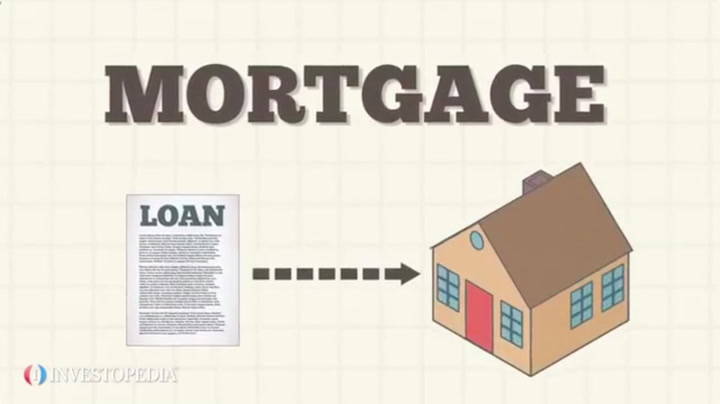

What is a mortgage? – Learn it!

A mortgage is a loan used to buy a home or property. In this case, the home acts as security for the loan, so if you don’t make payments, the lender can take the house. Mortgages usually last 15 to 30 years, and you pay back the loan in monthly installments.

These payments include both the amount you borrowed (the principal) and the interest. Mortgages help people buy homes without needing to pay the full price upfront.

Read More: Understanding the IP Address 35.186.175.7: A Comprehensive Guide

How does a mortgage work? – Step by Step!

A mortgage helps you borrow money to buy a home. Here’s how it works:

1. Application:

The mortgage application is the first step to getting a loan for a home. You need to give your personal details, like your name and address. The lender will also ask about your income, like pay stubs or tax returns, to see if you can pay back the loan. You should include information about your debts and monthly expenses too.

2. Approval:

If everything is good, the lender will approve your loan, meaning they will lend you the money to buy the home. They might ask for more documents before giving a final decision. If you’re approved, you’ll receive an offer with the loan amount, interest rate, and terms.

3. Down Payment:

A down payment is the amount of money you pay upfront when buying a home. It is usually a percentage of the home’s total price. For example, if you buy a house for $200,000 and make a 20% down payment, you would pay $40,000 upfront.

4. Loan Terms:

Loan terms are the rules you agree to when you get a mortgage. They include how much money you borrow, the interest rate, and how long you have to pay it back.Common loan terms are 15, 20, or 30 years. A longer term means lower monthly payments, but you will pay more interest over time.

5. Monthly Payments:

Monthly payments are what you pay every month for your mortgage. They include three main parts: the principal (the money you borrowed), the interest (the cost to borrow that money), and sometimes property taxes and insurance.

How do I qualify for a mortgage? – Read also!

To qualify for a mortgage, lenders check a few key things. First, they look at your credit score, which shows how good you are at paying back money. A higher score can help you get a better interest rate. They also want to see proof of your income, like pay stubs or tax returns, to make sure you can afford the monthly payments.

Lenders will also look at your debt-to-income ratio, which compares your monthly debts to your income. A lower ratio is better because it means you have more money to pay the mortgage. The amount of your down payment also matters; putting more money down can help you qualify more easily.

Read More: Traveling from 5012 Odeum Ct to 121 Jeannie St

Can I pay off my mortgage early? – Dont miss out!

Yes, you can pay off your mortgage early, but there are a few things to consider. Many lenders allow you to make extra payments toward the principal, which reduces the amount you owe and can save you money on interest. Some mortgages may also have a prepayment penalty, which is a fee charged for paying off the loan early.

It’s important to check your loan agreement for any such penalties.If you want to pay off your mortgage early, you can do this by making additional monthly payments or by making a lump-sum payment whenever you have extra money

What are the different types of mortgages? – Get Started!

There are different types of mortgages, each for different needs:

- Fixed-Rate Mortgage: This is the most common type. The interest rate stays the same for the entire loan, usually 15 or 30 years, so your monthly payments don’t change.

- Adjustable-Rate Mortgage (ARM): The interest rate starts lower but can change after a few years (like 5 or 7). This means your monthly payments can go up or down.

- FHA Loan: These loans are for low-to-moderate-income buyers. They require a smaller down payment and are easier to qualify for.

- VA Loan: Available for veterans and active-duty service members, VA loans often need no down payment and have good interest rates.

- USDA Loan: This is for people buying homes in rural areas. It requires no down payment and helps low-to-moderate-income families.

- Interest-Only Mortgage: For a certain period (usually 5-10 years), you pay only the interest. After that, you pay both interest and principal, which can make payments higher later.

What are closing costs in a mortgage? – just Amazing!

Closing costs are fees you pay when you complete the process of buying a home and getting a mortgage. These costs usually range from 2% to 5% of the home’s price. They can include things like appraisal fees, which check how much the home is worth, and title insurance, which protects you from legal issues related to ownership.

You also pay loan origination fees to the lender for setting up your loan, and credit report fees to check your credit history. Additionally, there are escrow fees for managing the sale, and you might need to pay some property taxes upfront.

How can I improve my chances of getting a mortgage? – Chect it out!

Improving your chances of getting a mortgage involves a few key steps. First, maintaining a good credit score is crucial, as lenders typically prefer scores of 620 or higher. To boost your score, pay bills on time, reduce outstanding debts, and avoid taking on new debt before applying.

Next, saving for a larger down payment can help, as a down payment of 20% or more may eliminate the need for mortgage insurance and show lenders that you are financially responsible. Additionally, having a steady job and a consistent income demonstrates stability, making you a more attractive borrower.

Read More: 505556454 – A Complete Guide

FAQs:

1. What credit score do I need for a mortgage?

Most lenders want your credit score to be at least 620. A higher score can help you get better rates. To improve your score, pay your bills on time and try to reduce your debts.

2. How much should my down payment be?

Many lenders allow a down payment of 3%, but 20% is better. A larger down payment shows you are responsible and can help you avoid extra costs like mortgage insurance.

3. What documents do I need to apply for a mortgage?

You’ll need to provide some documents, like your tax returns, pay stubs, bank statements, and details about your debts. Having these ready can make the process faster and easier.

4. How can I show I have a stable income?

Lenders like to see that you’ve had the same job for at least two years. If you’re self-employed, having proof of steady income helps your application too.

5. Should I get pre-approved for a mortgage?

Yes, getting pre-approved is smart. It shows sellers you are serious and helps you know how much you can afford, making your home search simpler.

Conclusion:

To improve your chances of getting a mortgage, start by working on your credit score. A higher score can help you get better loan options. Save for a larger down payment, as this shows you are responsible and can lower your overall costs. Make sure to gather all the required documents to make the process smoother.

Read More: